Welcome to Blockchain Island

How Malta wants to become the world’s first blockchain-regulated state

Interview with Steve Tendon, Strategic Advisor at the National Blockchain Strategy Taskforce of the Office of the Prime Minister of Malta and Founder of the Blockchain Malta Association

Kurz und bündig:

Der Wandel Maltas zum “Blockchain Island” soll eine bessere Förderung sozialer Projekte ermöglichen und darüber hinaus die Korruption einschränken. Hierbei helfen Krypto-Währungen und neue Crowdfunding-Modelle, die auf Distributed Ledger Technologies basieren. Im Februar 2018 veröffentlichte Malta drei Gesetzesvorlagen, um die bisher kleinen Krypto-Community zu stärken und weltweit eine Pionierrolle einzunehmen.

Cryptocurrencies and new crowdfunding models based on Distributed Ledger Technologies (DLTs) promise faster startup financing for social projects and less corruption. However, the crypto community is still very small and operates in legal gray areas. Consumers are rather deterred because the lack of regulation of the new market opens the door to criminals. Malta, one of the smallest European countries, wants to change that now with clearly established regulatory frameworks for DLTs, Initial Coin Offerings (ICOs) and virtual currencies. We met Steve Tendon on Malta for more details.

IM+io: Mr. Tendon, why should Malta become the first blockchain-regulated state?

ST: Malta is a small island state literally in the middle of the Mediterranean Sea. Strained off resources, historically its population has lived of fishing, farming, crafts, and commerce. More recently it developed a modern service economy, especially in the areas of financial services, i-Gaming, maritime, pharmaceuticals, etc.. The financial services and i-Gaming sectors are a very significant part of the economy. For instance i-Gaming is like 12 percent of the Gross Domestic Product (GDP). Both financial services and i-Gaming could be threatened by future regulatory developments in the European Union (EU) or in other jurisdictions. The Blockchain economy is shaping up to be a major element – and Malta wants to capture a sizable portion of all markets developing on top of Blockchain technologies. The ambition is to let this become as significant as the iGaming sector, and maybe even more.

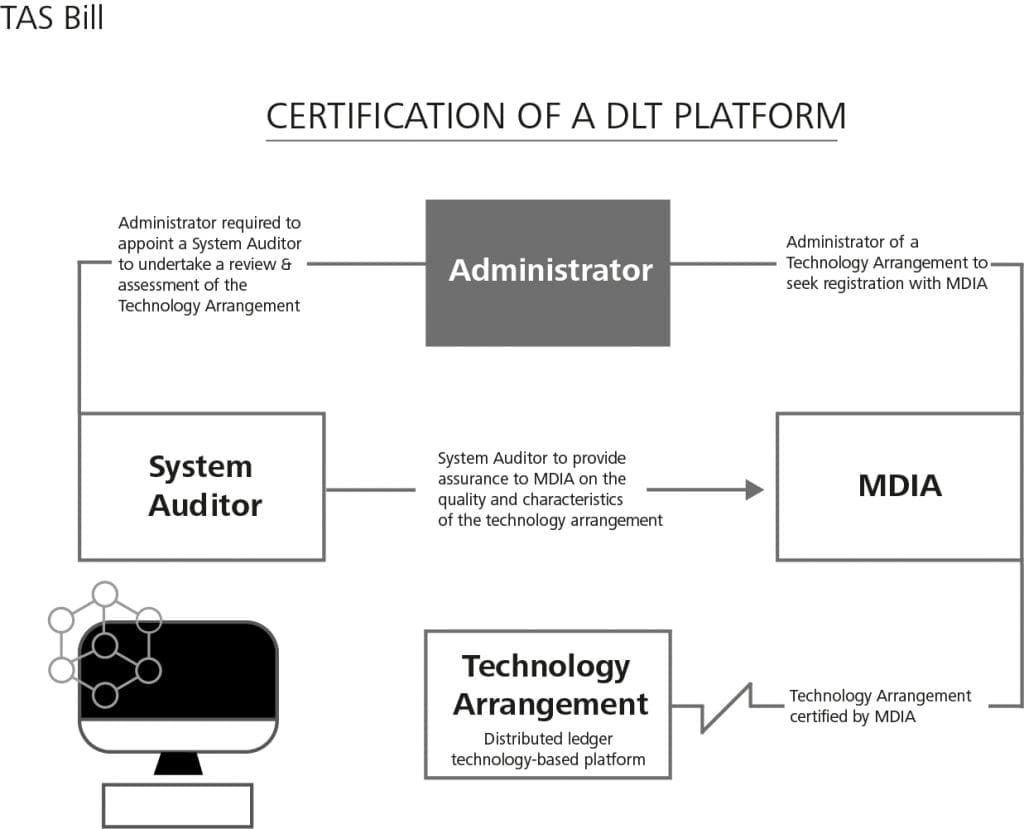

IM+io: What are ICOs and why do they still happen in the grey area?

ST: ICOs are a means for a start-up to raise funds directly. It is similar to crowdfunding, in that anybody can decide to participate in the funding. Yet, being built on top of Blockchain technologies, there is no intermediary crowdfunding company or platform. It provides the services of platforms like Kickstarter, Indiegogo, Patreon and similar ones, but without the platforms themselves. Participating – as an investor – in an ICO is like giving cash directly to the start-uppers. Now, since this space was completely unregulated, once the phenomenon exploded on the scene in 2017, there have been a number of scams, ponzi schemes and frauds done through ICOs. This is a negative development, because the concept of an ICO is truly an innovative way for start-ups to find money for their projects. It is a pity that a funding means with such huge potential is being tarnished by a number of equivocal actors. In order to bring some order to the space, Malta is proposing a number of new laws and rules.

IM+io: What is the Maltese government planning to do?

ST: While Malta is not the first country to regulate this space, it was definitely one of the first ones that started designing new regulations. The effort started in summer of 2016, when I was engaged by the Ministry of Economy, Investments and Small Business to draft the National Blockchain Strategy. That‘s where the vision of „Blockchain Island“ first took shape.

From the very beginning I set out to create a crypto-friendly environment – and in particular one designed for Generation 2 Blockchains, meaning those that support decentralized computation – like the Ethereum Blockchain – and give rise to things like smart contracts and Decentralized Autonomous Organizations (DAOs).

The regulatory initiatives that we have seen in the last 6 to 9 months in other countries have all been provoked by the spectacular rise – and then fall – of bitcoin and other cryptocurrencies, and the explosion of ICOs. Regulators had knee-jerking reactions and addressed only the financial effects of these technologies. They only considered the effects of Generation 1 Blockchains, those limited to decentralized storage of value (like bitcoin and similar ones).

Malta‘s plan was much more ambitious from the outset: Malta set out to address the rewiring of the internet that will happen through the decentralized computation of Generation 2 blockchains, and that will affect any business in the modern world.

Even if Malta‘s new laws and rules are not the first, they will definitely give the country a head start compared to others; they will be the first catering for Generation 2 Blockchains.

Furthermore, compared to places like Singapore, Hong Kong and Dubai, Malta – being a full member state in EU – needs to comply with EU regulations from Brussels. This has complicated matters, and required even more time. The positive aspect is that Blockchain businesses taking home in Malta will have their services „passportable“ to the rest of the EU.

What has been done? The Government gave the project top priority, by creating the new Ministry for Financial Services, Digital Economy and Innovation, under the leadership of Hon. Silvio Schembri. He set up the National Blockchain Task Force, of which I am a member, with the specific purpose of turning the envisioned strategy into actions.

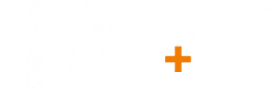

Some tangible results are already visible. For instance, in the public services sector, the Ministry for Education will record academic titles on the Blockchain. Other projects will cover land registry and possibly digital identity. But, for the economy at large, the initiative that will have the most impact is the drafting of the new laws. They were presented on February 16, 2018 [2], in the form of three proposed bills: the Malta Digital Innovation Authority bill (MDIA), the Technology Arrangements and Services bill (TAS) and the Virtual Financial Assets bill (VFA). The first one aims a creating an authority that, unlike what has been reported, does not regulate technology but cares about promoting innovation through technology, all the while protecting public interest. The second one is the really interesting one, where all the innovation in legislation takes place to see how Blockchains, Distributed Ledger Technologies, Smart Contracts, DAOs, and DACs can legally fit into society. There will be new subjects, like system auditors, technology services providers and administrators that will be recognized. The third bill is the least surprising one: it is basically taking care of crypto-currencies and ICOs; it is the equivalent to what other jurisdictions have done so far in reaction to the success of Generation 1 Blockchains. But it is in the first two bills that we find the unique handling of Generation 2 Blockchains.

For example, one of the most controversial provisions in the TAS bill is about recognizing legal personality for DAOs and Smart Contracts[3]. As of this time, the bills have not been approved by Parliament yet; and it might very well be that these proposals will be deemed too extreme. But it goes to show how deep the design and thinking has been around the challenges that these new technologies pose.

IM+io: How will this affect Malta and the rest of the world?

ST: It is early to say, and it depends on so many factors. It depends on what eventually will actually be approved in the new laws. If the crypto-entrepreneurs see the new laws as beneficial or not for them. How other jurisdictions react; and on international agreements.

No matter what, Malta will have set an important keystone in showing the world that Generation 2 Blockchains need to be thought of in different terms than Generation 1 Blockchains: they pose so many more social, political, economical and legal challenges that it will certainly take time to get everything into a generally acceptable shape and form.

For sure, the ambition of Malta is to become the „Blockchain Island“ where digital innovators and entrepreneurs find the most favorable conditions. Not only for their business as such, but also for their creations, like Artificial Intelligence (AI) and DAOs, which could have the traits of autonomy and self-sufficiency – in other words, for those new digital entities with which all of us, humans, will have to interact with in the future. Malta wants to be the welcoming home of these new entities! As an investor I would not be too much concerned with the roller coasters of bitcoin and other cryptocurrencies‘ valuation. The real opportunities will be in the technologies that will develop on top and around decentralized computation and AI.

IM+io: How do you plan to involve the public?

ST: I am sure that the Communication Department of the Government is already working on a communication strategy. And I think that the term „Blockchain Island“ will help us to engage people from all over the world. While many will naturally associate the „island“ with the physical island of Malta, my original vision was and is radically different. I first publicly described the idea of the „Blockchain Island“ at a conference and wrote about it on my (old) blog in October 2017[4]. The idea is not about an island, but about a virtual jurisdiction, that exists in the crypto-sphere, and wherein a new ecosystem of free economic actors can create a new economy based on crypto-technologies. The declared intent is to turn Malta into a new crypto-economic superpower, within the crypto-sphere. It is about claiming a new space therein, and provide the best environment for crypto-entrepreneurs and crypto-citizens to thrive; unencumbered by physical limitations; with a global reach. To get through to the people I also founded the Blockchain Malta Association. It is a great institution to educate all people in Malta about Blockchain technologies and to promote this idea of the „Blockchain Island“ as a new economic space where Malta would become an undisputed leader. Will it happen? Time will tell…